ESG, once a climate ethics compliance has become humongous than the capital market itself. If not addressed now, ignorance can cost founders’ years of fortune. Ever imagined, Why? The answer lies in a Consumer Intelligence study by PWC. The survey quotes that 76% consumers are of opinion that “I will discontinue my relationship with companies that treat the environment, employees, or the community in which they operate poorly.” The solution is a mix of three key stakeholders –Consumer, Financial Market and ESG Branding. In its initial phase, ESG had been a ticking box where investors enquired, “Do you have a XYZ policy or commitment to E or S or G?”. Moving beyond the noise of climate ethics and Anti ESG movement, investors are making decisions on ESG strategies. As per Mckinsey & Company, institutionalized investors have started using consumer intelligence and with the onset of consumer branding of sustainable businesses, ESG tops the chart.

Table of Content

- Strategy for Conscientious Consumers

- Beyond the Compliance Gap

- How Founders can gauge investor’s ESG expectation

- From the Lens of Employees

- Editor’s Note

It is vital for founders and board decision makers to note that, “changing consumer behavior along with stock market appreciation of ESG loaded companies has completely changed the coarse of ESG or no ESG debate.”

Strategy for Conscientious Consumers

Undoubtedly, founders need an ESG Strategy. The one that focuses on ESG holistically, rather than fund allocation. At the epicenter of this paradigm shift lies the changing consumer behavior. 80% of customers prefer brands that are disciplined at environmental policies, 76% for social, and 80% for corporate governance inside the organization. Consumers of 2023 understand that ESG has become the root of many solutions for consumers. Starting with sustainability and moving beyond immediate profits, customers are looking for brands that stand ethically progressive.

One of the prime reasons for ESG is its social impact through climate change. The other is governance of organization with their employees which directly affects customer experience. This has resulted into woke-ism of customers, opening room for investors to invest in companies empowered with ESG policies.

Consumer expectations play a crucial role in shaping the behavior and decision-making of companies. In the context of ESG policies, consumers are increasingly demanding businesses to demonstrate a commitment to addressing environmental, social, and governance issues.

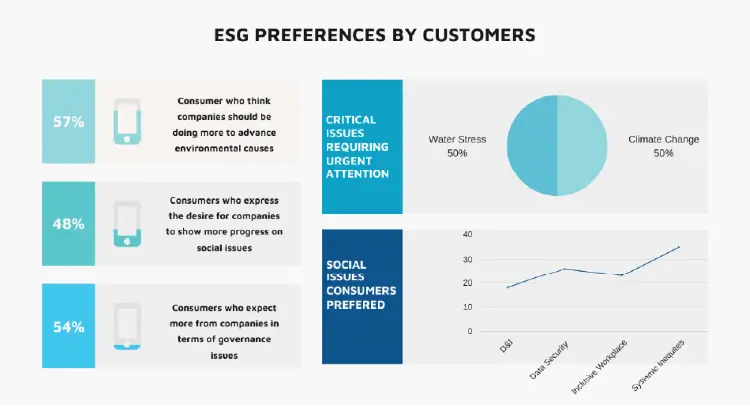

The following analysis by PWC research sheds light on consumer perspectives:

Environmental Issues: More than half of consumers (57%) believe that companies should be doing more to advance environmental causes. Climate change and water stress are highlighted as critical areas requiring urgent attention. Consumers expect companies to take proactive steps to reduce their environmental footprint, promote sustainable practices, and support initiatives aimed at mitigating climate change.

Social Issues: Nearly half of consumers (48%) express the desire for companies to show more progress on social issues. This includes areas such as diversity and inclusion (D&I) and data security and privacy. Consumers expect companies to foster inclusive workplaces, prioritize data protection, and actively contribute to social causes that address systemic inequities.

Governance Issues: A significant percentage of consumers (54%) expect more from companies in terms of governance issues. This entails complying with laws and regulations and addressing widening pay gaps. Consumers seek transparency, accountability, and ethical leadership from companies, with an emphasis on fair treatment of employees and responsible executive compensation.

Beyond the Compliance Gap

ESG compliance is not a purchase or investment decision point anymore. Now pre-purchase consumer behavior demands businesses to do more than the audit requirement.

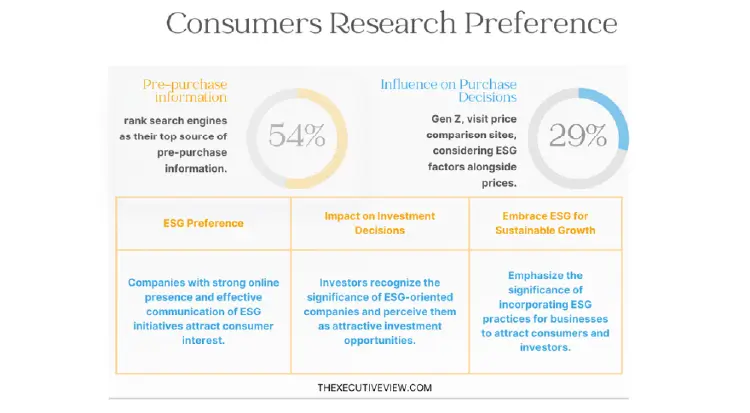

In a PWC survey, consumers revealed that they begin by scouring the internet to a mass information about a particular product or service, compare prices, read reviews and consider retailers. This marked the first-time when consumers were asked to identify their research preferences. More than half (54%) ranked search engines as the top source of pre-purchase information. E-commerce aggregator Amazon came in second, at 35%, followed closely (33%) by individual retailers’ websites, which are also used by 31% of respondents over customer reviews. Sites that specialize in price comparisons are visited by 29% of pre-purchasers—a majority of whom are gen Z.

Consumer behavior is evolving beyond merely considering the compliance practices of companies. Today, consumers are actively seeking out businesses that incorporate comprehensive environmental, social, and governance (ESG) practices. This shift in consumer behavior has significant implications for businesses and investors alike. Data from a recent survey highlights the impact of consumer preferences and the growing influence of ESG on business success:

In the survey, consumers were asked about their research preferences before making a purchase. Over half of the respondents (54%) identified search engines as their top source of pre-purchase information. This indicates that consumers are proactively seeking information about products and services, including details about a company’s ESG practices. It highlights the importance of companies having a strong online presence and effectively communicating their ESG initiatives to attract consumer interest.

E-commerce aggregator Amazon emerged as the second most popular source of pre-purchase information at 35%. This suggests that consumers value the transparency and accessibility of information provided by platforms that aggregate products and services. For businesses, being present on such platforms and showcasing their commitment to ESG can significantly enhance their visibility and reputation.

Individual retailers’ websites were ranked closely behind, with 33% of respondents utilizing them to read customer reviews and gather information. This emphasizes the importance of companies proactively providing ESG-related information on their websites to engage consumers and demonstrate their commitment to sustainability and social responsibility.

Notably, sites specializing in price comparisons were visited by 29% of pre-purchasers, particularly among the Gen Z demographic. This finding suggests that younger consumers are not only price-conscious but also consider ESG factors when making purchasing decisions. For businesses, incorporating ESG practices can provide a competitive edge in attracting and retaining these environmentally and socially conscious consumers.

The growing consumer demand for ESG-oriented companies has caught the attention of investors. As businesses that prioritize ESG gain popularity among consumers, they are also perceived as more attractive investment opportunities. This has led Investors in recognizing that companies with robust ESG practices are better positioned for long-term success, reduced risk, and enhanced financial performance.

As a result, investors are directing their capital towards companies that demonstrate a strong commitment to ESG, resulting in a positive feedback loop that rewards companies for their sustainability efforts.

How Can Founders Guage Investor’s ESG Expectation?

The evolving wind of capital market—guided by ESG trends and consumer behavior has became a guiding light for investors, across all industries. Now, institutional investors are knitted strongly with ESG policies provide that companies with low ESG performance are not expected to hit the top of stock market.

One of the big four accounting firms – KPMG International Limited, provides a three step guide that explain on what founders, directors and companies need to fulfill investors ESG expectation.

Understand Investor’s – ESG Commitment, What They Exclude and How Is Their Portfolio?

As the foundation, companies need to align their ESG policy with wide spectrum of investor’s commitment.

- Governance and Management Commitment:

Investors place significant emphasis on robust ESG governance within a business. They seek insight into the involvement and commitment of corporate management and the Board of Directors in addressing environmental and social issues. Founders should showcase unwavering dedication to ESG principles within their management team and board, accompanied by effective systems to address sustainability matters. Leveraging guidance from reputable sources like the Global Reporting Initiative (GRI) can facilitate the development of management indicators and best practices for non-financial governance.

- Alignment with ESG Fund Criteria:

When targeting specific ESG funds for investment, founders must diligently understand the specific investment criteria outlined in their mandates. These funds often focus on distinct areas, such as alignment with the UN Sustainable Development Goals (SDGs), renewable energy, forestry, and more. Founders should assess the alignment of their business with these criteria and adeptly communicate how they address the ESG priorities specified by the funds.

- Access to Sustainability Indices and Rankings:

The proliferation of ESG investment indices and rankings has posed a challenge for investor relations (IR) teams, requiring meticulous data management. Identifying the indices and ratings that hold the most influence with the investor base is essential. Founders should concentrate on enhancing their company’s performance in these pivotal ESG indices and rankings over time. Esteemed ESG research services, including MSCI ESG Research, RobecoSAM Group, Bloomberg, Thomson Reuters, Sustainalytics, and ISS’s E&S Quality Score, can provide valuable insights. By improving performance in these reputable assessments, founders can demonstrate unwavering commitment to ESG and bolster investor appeal.

- Learning from Sector Peers:

An astute founder should study how leading companies within their sector effectively manage ESG communications with investors. Analyzing successful strategies, understanding lessons learned, and assessing challenges faced by industry counterparts will enable founders to enhance their own communication strategies and differentiate their company within the market.

From The Lens of Employees

Harnessing the support of employees is crucial for companies to successfully achieve their environmental, social, and governance (ESG) goals. This segment emphasizes the significance of aligning corporate values with employees’ work and explores the statistical impact of employee engagement on ESG initiatives. By leveraging employee interests, providing opportunities for engagement, and fostering skill development, companies can empower their workforce to drive sustainable practices and achieve ESG objectives.

- Connecting Work to Values:

Aligning employees’ work with corporate values is key to fostering a sense of purpose and motivation. Statistics reveal that employees who perceive strong alignment between their work and company values are 3.5 times more likely to be engaged and satisfied with their jobs (Source: Gallup). By establishing a work environment that resonates with employees’ values, companies can enhance employee motivation and commitment to ESG goals, resulting in higher levels of performance and productivity.

- Leveraging Employee Engagement:

Employee engagement is a critical driver for the success of ESG initiatives. Research indicates that highly engaged employees are 87% less likely to leave their organizations (Source: Corporate Leadership Council). By actively involving employees in decision-making processes related to sustainability, companies can tap into their creativity and insights, leading to innovative ideas and improved sustainability practices. Engaged employees become passionate advocates for ESG goals, driving positive change throughout the organization.

- Empowering Through Upskilling:

Providing employees with opportunities for growth and development in ESG-related skills is essential for driving progress. According to a study by Deloitte, 70% of employees feel more engaged when their employers offer development opportunities. By investing in training programs that enhance employees’ understanding of sustainability practices, companies empower their workforce to contribute effectively to ESG goals. This, in turn, leads to improved performance, greater innovation, and increased capacity to address sustainability challenges.

- Enabling Idea Sharing and Growth Opportunities:

Establishing channels for employees to share ideas and identify opportunities for ESG initiatives is crucial for fostering innovation and continuous improvement. Research shows that companies with effective idea-sharing processes are 3.5 times more likely to outperform their peers (Source: Boston Consulting Group). By creating an inclusive and collaborative environment that encourages idea sharing, companies can tap into the expertise and creativity of their employees. This not only drives progress on ESG goals but also cultivates a culture of sustainability and engagement.

Editor’s Note

The dynamics of the ESG landscape have evolved, with ethical considerations, now outweighing the influence of the capital market. Founders who fail to recognize this shift may face significant financial consequences. Consumer expectations and preferences play a crucial role in shaping companies’ behavior and decision-making. Consumers demand that businesses demonstrate a commitment to environmental, social, and governance issues. The rising popularity of ESG-oriented companies among consumers has also caught the attention of investors, who recognize the long-term benefits and reduced risks associated with robust ESG practices.

To navigate this new landscape successfully, founders must develop comprehensive ESG strategies that go beyond mere fund allocation. The strategy should focus on aligning corporate values with consumer demands, fostering employee engagement, and upskilling the workforce. Aligning employees’ work with corporate values creates a sense of purpose and motivation, leading to higher levels of engagement and satisfaction. Engaged employees become advocates for ESG goals, driving positive change within the organization.

By empowering employees through upskilling initiatives, companies enhance their capacity to address sustainability challenges and drive innovation. Establishing channels for idea sharing and creating a collaborative environment fosters continuous improvement and cultivates a culture of sustainability and engagement. By leveraging the support of employees, companies can achieve their ESG goals more effectively and drive positive financial outcomes.

– Shrutika Khedekar